Dane County, Wisconsin, is a vibrant community known for its progressive values, thriving economy, and commitment to public services. However, the steady rise in property taxes, driven by the Dane County Board’s spending priorities and school district budget referendums, is placing an unsustainable burden on elderly residents and working families. With 36 out of 37 County Board members identifying as Democrats or Progressives, the near-unanimous approval of tax increases with minimal debate has left many voters feeling ignored. It’s time for Dane County voters to demand accountability, transparency, and a budget that prioritizes affordability for all residents, especially our most vulnerable. This article explores the impact of property tax increases, critiques the county’s spending priorities, and offers solutions to ease the burden on taxpayers.

The Growing Property Tax Burden:

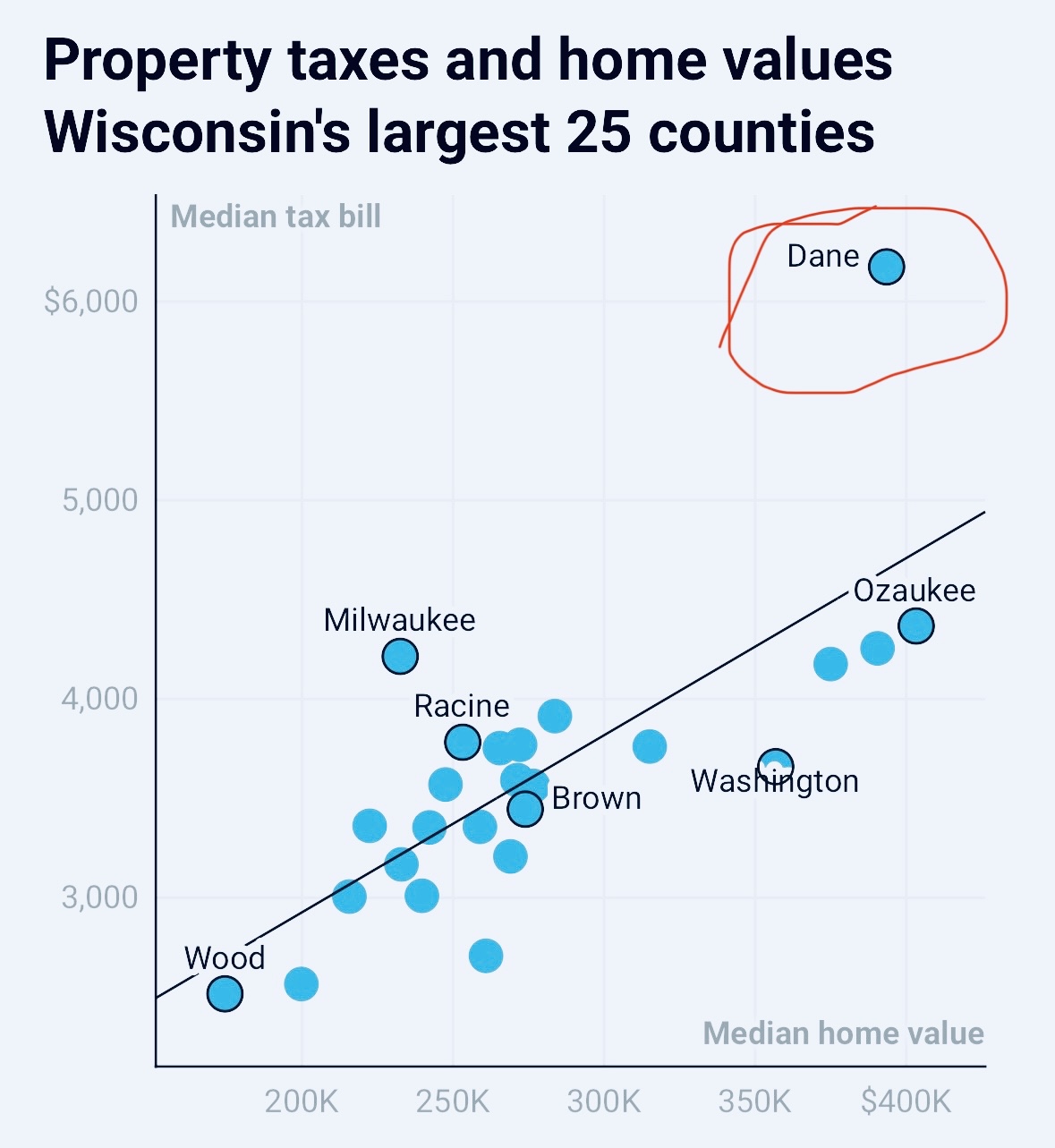

In recent years, Dane County homeowners have faced significant property tax increases, driven by rising county and school district budgets. For 2025, the Dane County Board approved a budget of $926 million, with a tax rate of $2.57 per $1,000 of equalized value, down slightly from $2.73 in 2024. However, this modest reduction masks the reality for homeowners: the average Madison home, valued at approximately $450,000, will see an additional $20 in county property taxes in 2025.

Combined with the City of Madison’s referendum, which adds $230 annually for the average home, and school district levies, the total tax increase for 2025 could exceed $350 for many households.

Looking ahead, the outlook is even more concerning. Dane County Executive Melissa Agard has projected a $31 million structural deficit for 2026, driven by rising operational costs, inflation, and state underfunding of mandated services. Without significant changes, this deficit could lead to further tax hikes or service cuts, both of which disproportionately affect elderly residents on fixed incomes and working families struggling with rising costs.

For the elderly, many of whom rely on Social Security or limited retirement savings, these increases are particularly burdensome. A $350 annual increase may seem manageable to some, but for seniors, it could mean cutting back on essentials like healthcare or utilities. Working people, already grappling with inflation and stagnant wages, face similar challenges, as higher taxes reduce disposable income for housing, childcare, and other necessities. The Wisconsin Policy Forum notes that Madison homeowners in the Verona School District pay among the highest property taxes in Dane County, with an average bill of $7,784 for a $400,000 home. These costs are expected to rise further as school districts pursue additional referendums.

Dane County’s Spending Priorities:

A Progressive Agenda at a Cost

The Dane County Board, dominated by Democrats and Progressives, has prioritized ambitious social programs, environmental initiatives, and infrastructure projects. The 2025 budget allocates $30 million for affordable housing, $10 million for conservation, and $16.6 million for highway projects, alongside increased funding for human services, veterans’ programs, and mental health initiatives. While these are worthy goals, the lack of rigorous debate over these expenditures—often approved with little discussion—raises questions about fiscal responsibility.

For example, the 2024 budget saw a 13.6% tax levy increase, driven largely by debt service costs and additional borrowing for affordable housing projects, such as $10 million for the Affordable Housing Fund and $8 million for farmworker housing. These initiatives, while addressing critical needs, add to the tax burden without sufficient consideration of cost-saving alternatives, such as public-private partnerships or reallocating existing funds.

The 2022 budget, signed by then-County Executive Joe Parisi, included $10 million for a Crisis Triage Center, $8.2 million for the “Hotels to Housing” program, and $5.25 million for a hotel conversion to affordable housing. These projects reflect a pattern of prioritizing large-scale social programs over immediate tax relief, a trend that has continued under Interim Executive Jamie Kuhn and now Melissa Agard. The Board’s near-unanimous approval of these budgets, often with minimal public input, suggests a disconnect from the financial realities faced by taxpayers.

School District Referendums: Adding to the Tax Burden

Dane County’s school districts are a significant driver of property tax increases, as they frequently turn to referendums to exceed state revenue limits. In November 2024, six Dane County school districts placed referendums on the ballot, with Madison Metropolitan School District (MMSD) securing approval for two major measures: a $100 million recurring operating referendum and a $507 million capital referendum. These will add $327 annually to the average homeowner’s tax bill starting in December 2025, continuing for 23 years until the debt is retired.

Other districts, such as Deerfield, Belleville, and Marshall, also passed referendums in 2024, adding millions to local tax levies. For instance, Deerfield’s $8.75 million referendum and Belleville’s $8.8 million referendum will increase taxes by hundreds of dollars annually for homeowners, depending on property values. While these funds support critical educational needs—such as teacher salaries, facility upgrades, and curriculum—the cumulative effect of multiple referendums across jurisdictions is overwhelming for taxpayers.

The state’s revenue limits, which have not kept pace with inflation since 2009, force districts to rely on referendums, but the Dane County Board’s failure to advocate for structural reforms, such as increased state aid or a revised funding formula, exacerbates the problem. The Board’s progressive majority has not prioritized lobbying the state for solutions, instead allowing local taxpayers to bear the brunt of rising costs.

The Toll on the Elderly and Working People:

For elderly residents, property tax increases threaten financial stability. Many seniors live on fixed incomes, with Social Security benefits averaging around $1,800 per month. An additional $350-$500 in annual taxes represents a significant portion of their disposable income, forcing difficult choices between taxes and other necessities. For working families, these increases compound the challenges of rising housing costs, childcare expenses, and inflation. In Madison, where the median home value is $457,300, the combined impact of county, city, and school district taxes could push total bills well above $8,000 annually by 2026, a daunting prospect for middle-class households.

The Wisconsin Policy Forum highlights that Madison receives among the lowest per-capita state aid, forcing reliance on property taxes. This structural issue, coupled with the County Board’s spending habits, creates a cycle of tax hikes that disproportionately harms those least able to afford them.

Solutions to Reduce Property Taxes:

Dane County voters deserve a budget that balances community needs with affordability. Here are actionable steps the County Board can take to reduce property taxes:

1. Prioritize Spending Efficiency: The Board must scrutinize existing programs for cost-saving opportunities. For example, instead of allocating $30 million to new affordable housing projects, the county could redirect unspent funds from prior budgets or partner with private developers to share costs. Agard’s call for a 4% base reduction in department budgets for 2026 is a start, but deeper cuts to non-essential programs, such as cultural initiatives or discretionary grants, could provide relief.

2. Advocate for State Funding Reforms: The Board should pressure the state legislature to increase shared revenue and adjust the school funding formula to account for inflation. Madison’s low per-capita state aid is a systemic issue that requires aggressive advocacy, not passive acceptance.

3. Limit Referendum Dependency: The Board should work with school districts to reduce reliance on referendums by identifying efficiencies, such as consolidating administrative functions or leveraging technology to cut costs. Supporting districts in negotiating better vendor contracts could also lower expenses.

4. Increase Transparency and Debate: The Board’s habit of approving budgets with little discussion must end. Public hearings, like the one scheduled for June 4, 2025, at the Alliant Energy Center, should be expanded to include detailed cost-benefit analyses of major expenditures. Voters deserve to know how their tax dollars are spent and why alternatives were not considered.

5. Expand Tax Relief Programs: Enhance programs like the state’s Homestead Credit and lottery credit to better support elderly and low-income homeowners. The county could also explore a local tax deferral program for seniors, allowing them to delay payments until their property is sold.

A Call to Action for Dane County Voters:

The Dane County Board’s progressive majority has prioritized ambitious programs over fiscal restraint, resulting in a tax burden that hits elderly and working residents the hardest. With property taxes projected to rise further in 2025 and 2026, driven by a $31 million deficit and ongoing school referendums, the status quo is unsustainable. The Board’s near-unanimous approval of budgets with minimal debate reflects a lack of accountability to taxpayers.

Dane County voters have the power to demand change. Attend budget listening sessions, contact your supervisors, and vote for candidates who prioritize affordability and transparency. The elderly and working families deserve a county government that listens and acts responsibly. It’s time to hold the Dane County Board accountable and ensure our tax dollars serve the entire community, not just a progressive agenda.

Sources:

Wisconsin Policy Forum, Madison.com, DaneCounty.gov, WMTV15News.com, The Daily Cardinal, MacIver Institute, CapTimes.com, WPR.org, Isthmus.com